Functional Skills: Interest and Compound Interest

Interest and Compound Interest

Interest is something that you may see in questions involving money.

Make sure you are happy with the following topics before continuing.

Interest

Interest is a percentage of some money that is then added on to the total amount of money. For example, when you put money in a savings account it generates interest.

For LEVEL 1 you will only deal with interest in multiples of 5\%, but for LEVEL 2 you will need to deal will all percentages.

Example: Youri puts \textcolor{orange}{£4800} into a savings account that pays \textcolor{blue}{5\%} interest per year. How much money does Youri have in his savings account after 1 year?

Calculate \textcolor{blue}{5\%} of \textcolor{orange}{£4800}: 0.05\times £4800 = £4800 \div 20 = £240

Add this on to £4800: £4800+£240=£5040

This could be done in one step: 1.05\times £4800=£5040

Compound Interest

Compound interest is interest on money, which includes previous interest that has already been applied. For example, money saved in a bank account may earn interest every year (‘per annum’), so the following year’s interest will be calculated by taking into account the interest that was earned in the previous year.

Example: Tara takes out a loan of \textcolor{orange}{£700} from a loan company, who charge \textcolor{blue}{15\%} compound interest every month. Assuming Tara doesn’t pay back any of the loan, how much will she owe after 2 months?

After 1 month: 1.15\times £700=£805

After 2 months: 1.15 \times £805=£925.75

Follow Our Socials

Our Facebook page can put you in touch with other students of your course for revision and community support. Alternatively, you can find us on Instagram or TikTok where we're always sharing revision tips for all our courses.

Money in the Real World

Many questions require you to work with money in real world contexts. For example, you may be asked to evaluate a person’s budget, which may come in the form of a table or a list. Furthermore, you may also be asked to calculate the amount of tax someone needs to pay or how much they have left after income tax.

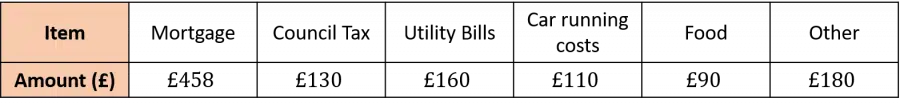

Example: Lauren has just moved into a new house and his calculating how much money she can put into a savings account each month.

Her monthly income after tax is \textcolor{red}{£1700}. Using the table below, calculate how much she can put into a savings account each month.

Adding up all her monthly expenditures: £458+£130+£160+£110+£90+£180=\textcolor{orange}{£1128}

Subtracting this from her monthly income: £1700-£1128=\textcolor{orange}{£572}

So she can put \textcolor{orange}{£572} into her savings account each month.

Example: Jamie earns \textcolor{red}{£27500} a year before tax. He isn’t taxed taxed on the first \textcolor{blue}{£12500} he earns (personal allowance), and then pays \textcolor{limegreen}{20\%} tax on all income over £12500. How much will Jamie earn after tax in one year?

Taxable income: £27500-£12500=\textcolor{orange}{£15000}

Tax on taxable income: 0.2 \times £15000=\textcolor{orange}{£3000}

Amount earned after tax: £27500-£3000=\textcolor{orange}{£24500}

Functional Skills: Interest and Compound Interest Example Questions

Question 1: Kevin takes a loan out for a holiday of £5600. The loan company charge 10\% interest on any money that is borrowed.

How much money will Kevin now owe back to the loan company?

[2 marks]

Calculate 10\% of £5600: 0.10\times £5600 = £5600 \div 10 = £560

Add this on to £5600: £5600+£560=£6160

Question 2: Phil puts £3900 into a savings account that offers 3.5\% interest paid yearly. Stacey puts £4250 into a different savings account that offers 2.8\% interest paid yearly.

Who will earn the most interest in one year and by how much?

[3 marks]

Phil’s interest: £3900 \times 0.035=£136.50

Stacey’s interest: £4250 \times 0.028=£119

Difference: £136.50-£119=£17.50

So Phil will earn the most interest in one year, by £17.50

Question 3: Rose wants to take out a loan of £900 to help her buy a car. Two different loan companies quote her two different deals for the loan.

Company A charge no interest on the first month of the loan, but then 3\% compound interest for each month after that.

Company B charge 2.2\% compound interest each month.

Rose plans on paying the whole loan back in one go after three months. Which company should she choose if she wants to pay the least amount of interest?

[3 marks]

Company A:

After 2 months (no interest after 1 month): £900 \times 1.03=£927

After 3 months: £927\times1.03=£954.81

Company B:

After 1 month: £900 \times 1.022=£919.80

After 2 months: £919.80\times1.022=£940.04

After 3 months: £940.04 \times 1.022=£960.72

Therefore, Rose should go with Company A.

Question 4: George has a yearly salary of £23000. He is not taxed on the first £12500 of his income, and then pays 20\% income tax on all earnings above £12500.

Each month, George pays £650 rent. Calculate what percentage of his monthly income (after tax) George pays in rent, to the nearest whole number.

[4 marks]

First calculate how much George earns each year after tax:

£23000-£12500=£10500

£10500 \times 0.2=£2100

£23000-£2100=£20900

Then calculate his monthly income after tax:

£20900 \div 12=£1741.67

Finally calculate the percentage of his monthly income he pays in rent:

\dfrac{650}{1741.67}\times100=37\% (rounded to the nearest whole number)

Specification Points Covered

L1.18 – Calculate simple interest in multiples of 5% on amounts of money

L2.13 – Calculate amounts of money, compound interest, percentage increases, decreases and discounts including tax and simple budgeting

Functional Skills: Interest and Compound Interest Worksheet and Example Questions

Interest L1

FS Level 1NewOfficial PFSInterest and Compound Interest L2

FS Level 2NewOfficial PFSRevision Products

Functional Skills Maths Level 2 Book

Revise and practice for your functional skills maths level 2 exam. All topics covered in this compact functional skills maths revision guide book.

Functional Skills Maths Level 2 Mini Tests

Practice for your functional skills Maths level 2, questions from every topic included.

Functional Skills Maths Level 2 Revision Cards

Revise for functional skills maths level 2 easily and whenever and wherever you need. Covering all the topics, with revision, questions and answers for every topic.

Functional Skills Maths Level 2 Practice Papers

This 5 set of Functional Skills Maths Level 2 practice papers are a great way to revise for your Functional Skills Maths Level 2 exam. These practice papers have been specially tailored to match the format, structure, and question types used by each of the main exam boards for functional skills Maths. Each of the 5 papers also comes with a comprehensive mark scheme, so you can see how well you did, and identify areas to improve on.

Functional Skills Maths Level 2 Practice Papers & Revision Cards

This great value bundle enables you to get 5 functional skills maths level 2 practice papers along with the increasingly popular flashcard set that covers the level 2 content in quick fire format.